Alphabet’s Earnings: Profits or Pitfalls? A Deep Dive

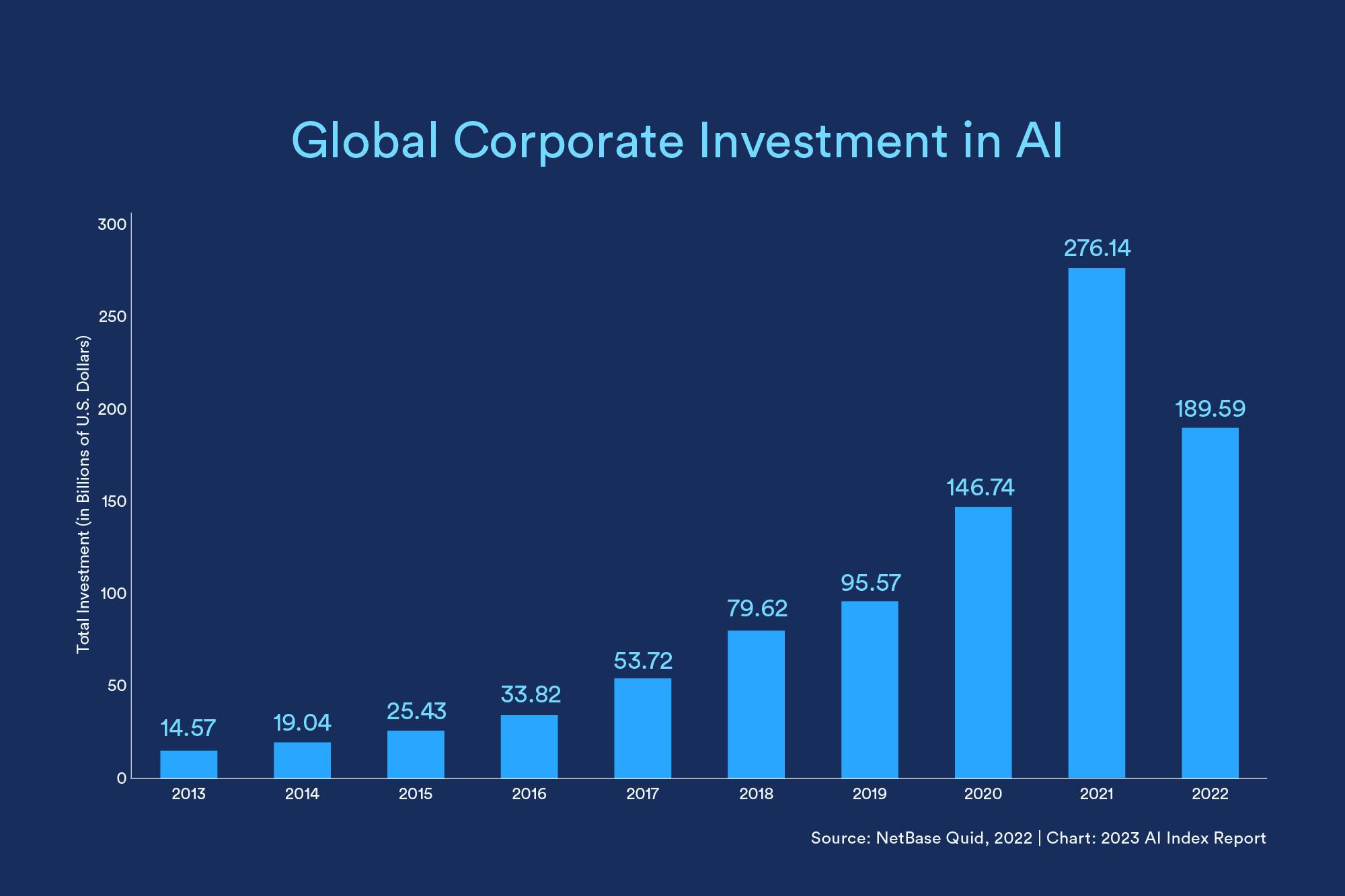

In the fast-paced world of technology, where innovation and investment go hand-in-hand, Alphabet’s latest earnings report arrives as a crucial touchstone for industry analysts and investors alike. Titled “Alphabet’s Earnings: Profits or Pitfalls? A Deep Dive,” this discussion ventures beyond the surface, exploring the intricate balance technology giants must maintain between investment in future capabilities and the immediate expectations of return. With the tech sector facing the dual pressures of soaring capital expenditures and the urgent demand for artificial intelligence services, Alphabet’s performance may well signal trends that extend far beyond its own bottom line.

As we delve into this deep dive, we’ll unpack the complexities surrounding capital expenditure in the tech industry—examining how increased spending can both reflect confidence in AI growth and simultaneously evoke concern from investors about returns. What does this mean for competitors like Microsoft and Amazon, and how does Meta fit into the narrative despite not being a major cloud provider? By considering these questions, we can better understand the larger implications of Alphabet’s earnings report, making sense of the delicate interplay between ambitious investment strategies and the fluctuating dynamics of market confidence. Join us as we navigate this critical intersection of profits and pitfalls in the tech landscape.

Understanding the Capital Expenditure Landscape in Big Tech

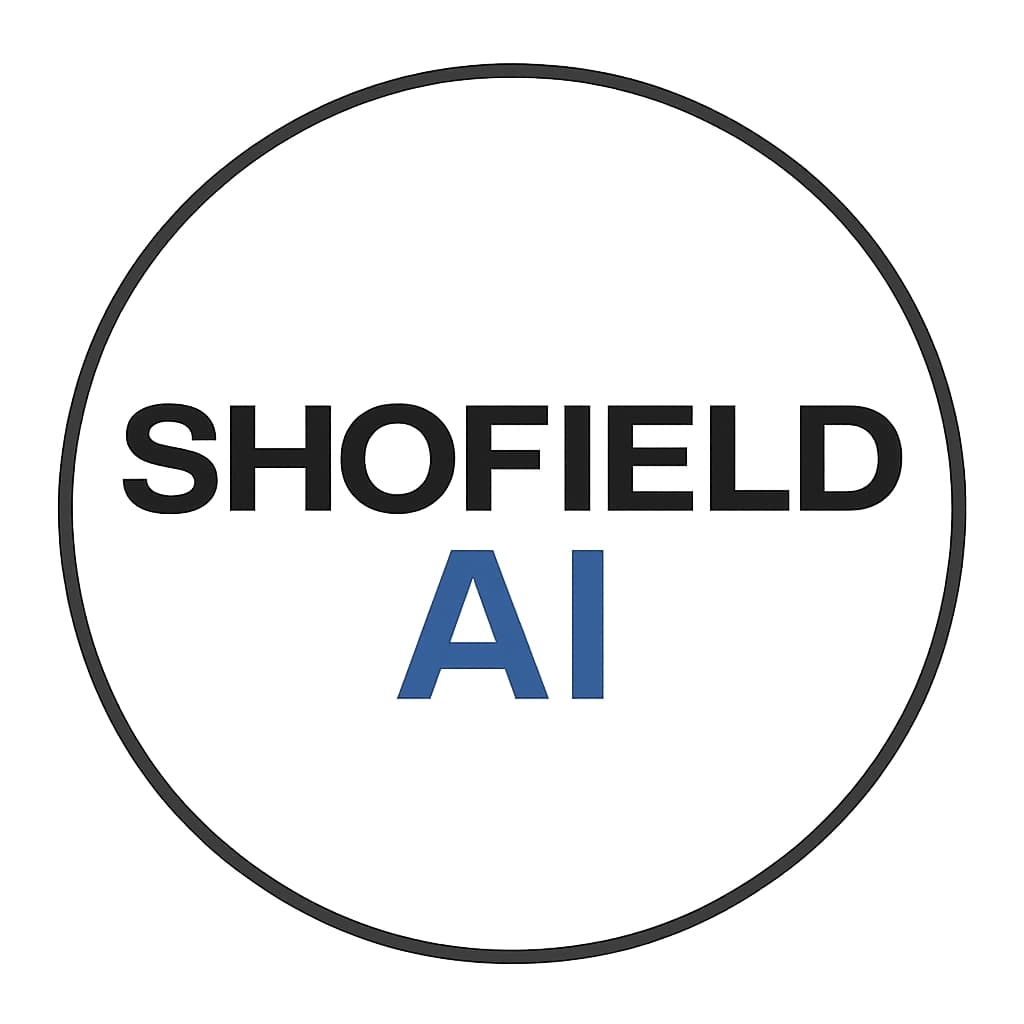

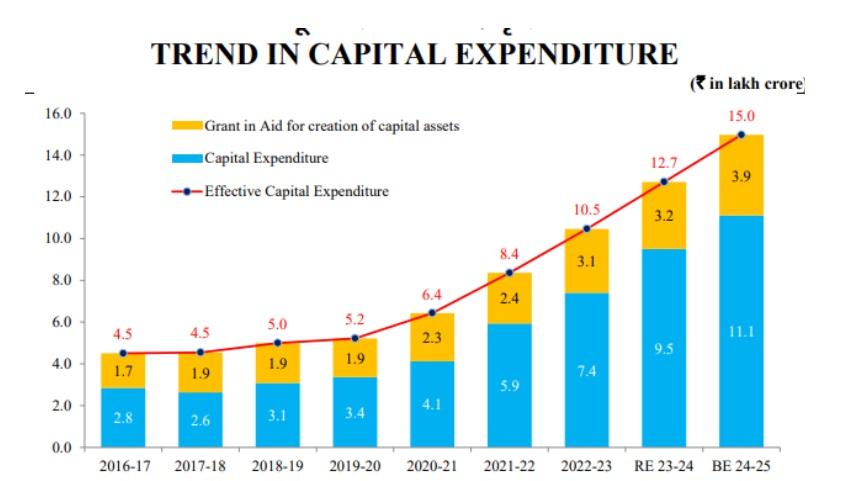

The current capital expenditure (capex) strategy employed by major players in the tech industry, particularly Alphabet, is increasingly viewed as a double-edged sword. As these hyperscalers ramp up their investments in infrastructure to capitalize on burgeoning demands for AI and cloud services, they simultaneously face pressure from investors who are keenly focused on returns. Increased spending generally signals confidence in future market conditions; however, if these investments do not yield proportional growth in profitability, investor sentiment can quickly sour. In the last reporting cycle, we witnessed this phenomenon as heightened spending without clear returns made investors apprehensive about the efficacy of such strategies.

This precarious balancing act resembles a “prisoner’s dilemma” for these companies. On one hand, substantial capex indicates a readiness to meet soaring demand; on the other hand, cuts in spending might be interpreted as a decrease in expected demand, leading to further market nervousness. In addition to Alphabet, other tech giants like Meta are making significant capex allocations, estimated to be on par with leaders in the cloud sector, not necessarily as indicators of external demand but rather to support internal growth and operational needs. Alphabet’s impending earnings report could serve as a crucial barometer, not just for its own health but also for the broader tech landscape, clarifying how these investments are shaping the future of enterprise software and AI adoption.

The Balancing Act: Navigating Investor Expectations with AI Investments

In the realm of technology investments, particularly within AI, companies like Alphabet face a complex balancing act. Increased capital expenditures (capex) can reflect a positive outlook on future demand, showcasing a company’s readiness to capitalize on the burgeoning AI landscape. However, investor sentiment is notoriously fickle, as unseen returns on these hefty expenditures may lead to skepticism about the company’s financial health. Investors are particularly vigilant about margin growth; without solid returns, they may question the viability of continued spending. As seen in the last quarter’s performance, such concerns can quickly escalate, leading to market jitters regarding overall tech confidence.

On the flip side, a reduction in capex may signal a lack of demand, potentially leading investors to panic for entirely different reasons. This is particularly pronounced in the case of Alphabet, which is set to report earnings that could set the tone for its peers. The situation can be likened to a prisoner’s dilemma: companies must weigh the risks of spending big against investor worries about returns while also reconsidering how AI investments might impact traditional enterprise software spending. Meta, for example, is investing significantly to meet its internal demands, suggesting that capex isn’t just about external signals of AI demand but also internal operational requirements, which could send mixed messages across the industry.

Metas Unique Position: Capital Expenditure Trends Beyond Cloud Services

Meta’s capital expenditure (capex) strategies present a unique angle in the tech landscape, particularly as the company invests heavily in its own services rather than directly competing in the cloud market like its counterparts, Google, Microsoft, and Amazon. With expectations that Meta will spend nearly as much on capex next year as these hyperscalers, it indicates a strong commitment to enhancing its internal infrastructure. This shift toward greater investment in GPUs and other resources reflects a strategic alignment with the rising AI demand while minimizing exposure to fluctuating external market caps. This trend underpins the essential need for businesses to have robust, scalable technology to support AI development, even as investors remain vigilant regarding the anticipated returns on these investments.

Furthermore, the dichotomy of capex spending is evident as Meta navigates a critical balancing act. As investors seek assurance regarding future demand and profitability, Meta’s approach may serve as a barometer for overall sentiment in the tech sector. The potential for capex to lead to greater efficiency, optimized internal processes, and the fostering of innovation becomes paramount. In a landscape where the risks associated with over-investment loom large, Meta’s position within this capex narrative not only highlights its evolving operational focus but also its influence on how other tech firms view their capital expenditures in response to AI advancements. This unique position allows Meta to leverage its spending for internal growth, setting a potentially lucrative path amid uncertainties widespread among its peers in the industry.

Implications for the Tech Industry: Insights from Alphabets Earnings Report

The recent earnings report from Alphabet holds critical implications for the tech industry, particularly in the realm of capital expenditures (capex). As major players in technology like Alphabet, Microsoft, and Amazon ramp up spending in expectation of growth from Artificial Intelligence (AI), the nuances of these investments reveal a complex landscape. Investors are now confronted with a double-edged sword: increased spending signals confidence and ambition but raises concerns if those investments do not yield the anticipated returns. Thus, Alphabet’s performance may serve as a bellwether for how the broader industry perceives the demand for AI-driven infrastructure.

Furthermore, the balance between capex spending and the anticipated returns is likely to shape market expectations moving forward. A significant contraction in capex could signal waning demand for AI, instilling fear among investors that the boom may be less robust than projected. On the other hand, continuous aggressive investments without corresponding gains may lead to growing skepticism. As Meta enters the capex conversation with high spending projections despite not being a traditional cloud provider, it adds layers to the narrative about supply and demand in AI services. Alphabet’s report is not just a snapshot of its financial health; it may fundamentally influence future investment strategies across the tech sector.

Key Takeaways

As we wrap up our exploration of Alphabet’s latest earnings report and its implications for the tech sector, it’s clear that we’re standing at a crossroads. On one hand, heightened capital expenditures signal a robust confidence in the future of AI and its potential to drive growth. Yet, this confidence comes with a trade-off; investors are left grappling with the dual concerns of spending without immediate returns or the potential risks of scaling back on necessary investments.

The discussion brought us insights into not only Alphabet’s position but also how their results might serve as a bellwether for other tech giants like Microsoft, Amazon, and Meta. As we’ve seen, the relationship between capital investments and demand in the AI landscape is complex and fraught with uncertainty. Will increased spending lead to the anticipated returns, or will it be a cause for concern?

As we keep an eye on the developments in the tech industry, it’s important to remember that the balance between investing in innovation and ensuring profitability is delicate. Alphabet’s earnings release will set the tone for many, guiding investor sentiment in what is undoubtedly a pivotal moment for the tech economy.

Stay tuned for further insights as we continue to track the ripples of this earnings season. The interplay between spending, demand, and investor confidence will certainly shape the future of technology—and we’ll be here to break it down for you. Thank you for joining us on this deep dive into Alphabet’s earnings. Until next time, keep questioning and exploring the fascinating world of tech!